Violently Sideways

· Not even war drums can knock the S&P 500 out of its sideways range

· AI hysteria overdone

· Don’t let geopolitics drive investment decisions

Does The Nice Rotation Turn Nasty?

· AI is at it again, new model release = another industry-specific selloff.

· Nice rotation keeps S&P 500 above 6,800 – trouble awaits below.

· The worst of the tariff uncertainty is in the rearview.

Markets Struggling To Ascend ‘Wall Of Worry’

· AI fear is making its way from one industry to another.

· ‘Good data, bad price action’ - equities shrug off solid jobs report, and better CPI inflation print.

· Rest of World equities continue to outshine U.S. equities.

Global Growth And Earnings Resilience Overpowering Unknowns

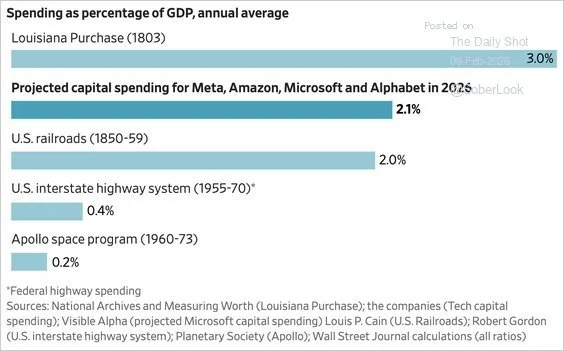

· MegaCap Tech spending splurge riles equity market.

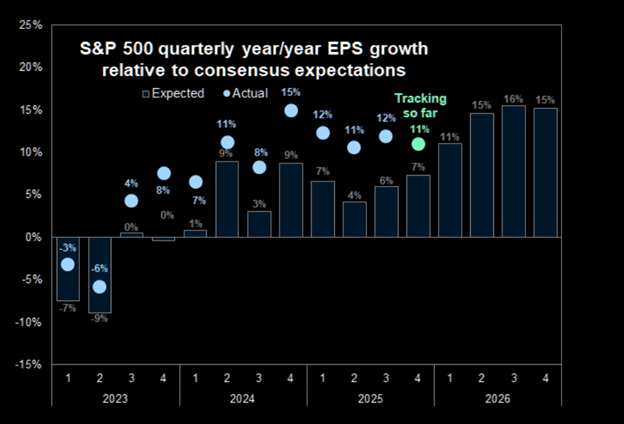

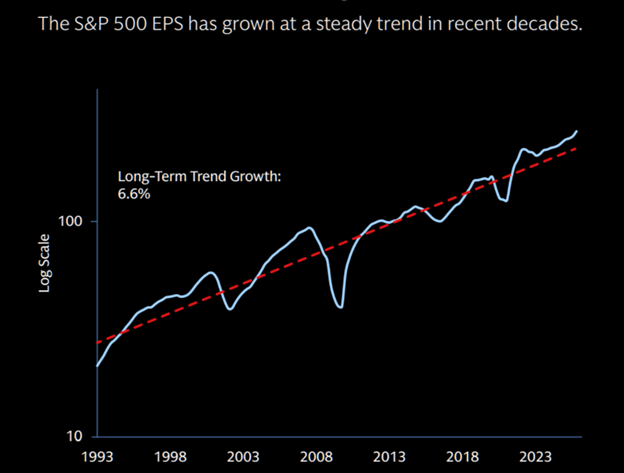

· But, economic growth tailwinds and earnings lend support.

· Periods of rapid change demand humility and discipline.

Markets Digesting Warsh As Next Fed Chair

· Markets react to Warsh getting Fed chair nomination.

· Latecomers to precious metals get humbled.

· S&P 500 not ratifying bullish narrative.

Some Thoughts In Between Shoveling

Precious metals mania - tread carefully.

Where does the upside come from for risk assets from here?

A chat with Alphabet’s Gemini AI.

Global Asset Markets Are Priced For ‘Goldilocks’, Not Chaos

· Risk-off in markets as Trump ups aggression in pursuit of Greenland.

· Rising bond yields adding pressure to heightened geopolitical uncertainty.

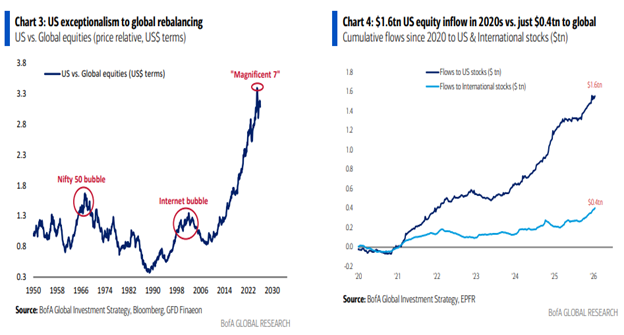

· Unwind of U.S. exceptionalism poses a big risk for investors.

Economic Resilience, Profits, And Flows ‘Trump’ Administration Noise

· U.S. equities off to a strong start, global equities even stronger.

· Markets correctly sifting ‘signal’ from ‘noise’.

· Uranium market set-up for fireworks.

It’s A Real Asset World, Until Proven Otherwise

· Last year's winners start 2026 where they left off.

· The transition from a unipolar world to a multipolar world is playing out.

· If 2026 meets expectations, it should be a constructive year.

Markets Repricing Increased Uncertainty

· AI theme getting questioned.

· Fed cuts rates, and looks to be on hold.

· U.S. National Security Strategy report asserts change is coming.

The Affordability Crisis Will Impact Policy

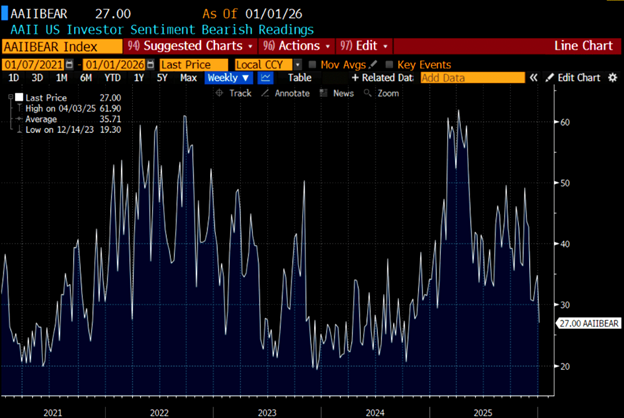

· Markets have been chopping sideways for the last 4-6 weeks.

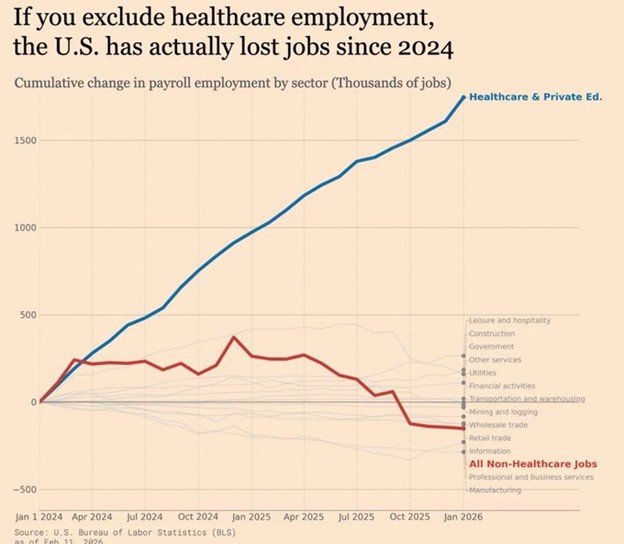

· Labor market showing wider cracks.

· Affordability frustration is about cumulative inflation costs, not YoY change.

In Need Of A Jump Start

· Holiday rally pushes the S&P 500 back up near all-time highs.

· Power capacity is the bottleneck in the AI revolution.

· Not much to get excited about (in either direction) in capital markets.

General Thoughts On Markets And Other Things

· Earnings from the largest company in the world didn’t disappoint.

· But the price action validates an ongoing character change in the AI theme.

· Markets got some clarity on uncertainties that have been worrying investors.

Window Of Vulnerability

· S&P 500 at risk of breaking levels that would trigger systematic selling by CTA and vol-control funds.

· Markets repricing for less accommodative Fed.

· Nvidia earnings on tap – can it save the AI theme.

Is Capitalism Under Threat?

· End of the shutdown sparks a risk-on rally.

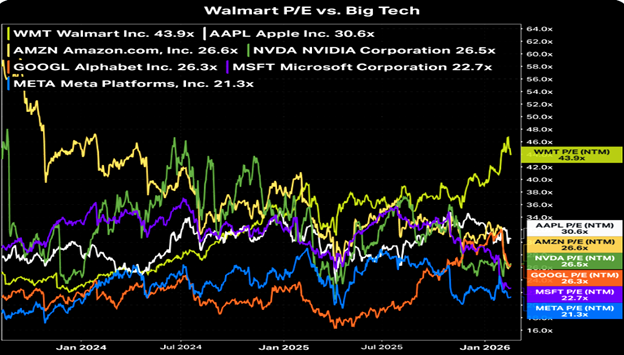

· Mega-cap tech spending spree getting stretched.

· The divide between the ‘haves’ and ‘have-nots’ is undermining capitalism.

Corporate Profits Fueling Equity Gains

· Q3 earnings helping to push equities higher – Mega Cap Tech reports on deck.

· Rarely mentioned, but global equities are having a great year.

· Is the energy sector underappreciated by investors?

Some General Thoughts

· Asset prices had a good week with gold showing its shine.

· U.S. and Chinese officials posture ahead of Trump/Xi meeting.

· This isn’t just a trade war – it’s for who sets global order over the next century.

Under Threat

· Tariff headlines drive volatility in both directions.

· There is a lot at stake in this U.S./China conflict.

· Diversification is not a dirty fifteen letter word.

Trade The Narrative; Own The Truth

· Data is sparse with the shutdown, but what we got wasn’t good.

· Lots of calls to embrace the everything rally – raises my skepticism.

· Debasement strategy becoming mainstream – as it should.

A Time For Vigilance And Prudence

· Markets await a slate of economic data, including the September jobs report on Friday if we’re able to avert a government shutdown.

· A good time to revisit return expectations and your financial objectives.